Fraud detection with graph analytics

A confidential project for the Government to support public officers with the detection of fraud in a business field where the government offers subsidies. It is known that fraud occurs, and the question was whether we can use the existing data to support the officers better in the field.

Business goal : Increase the fraud detection rate.

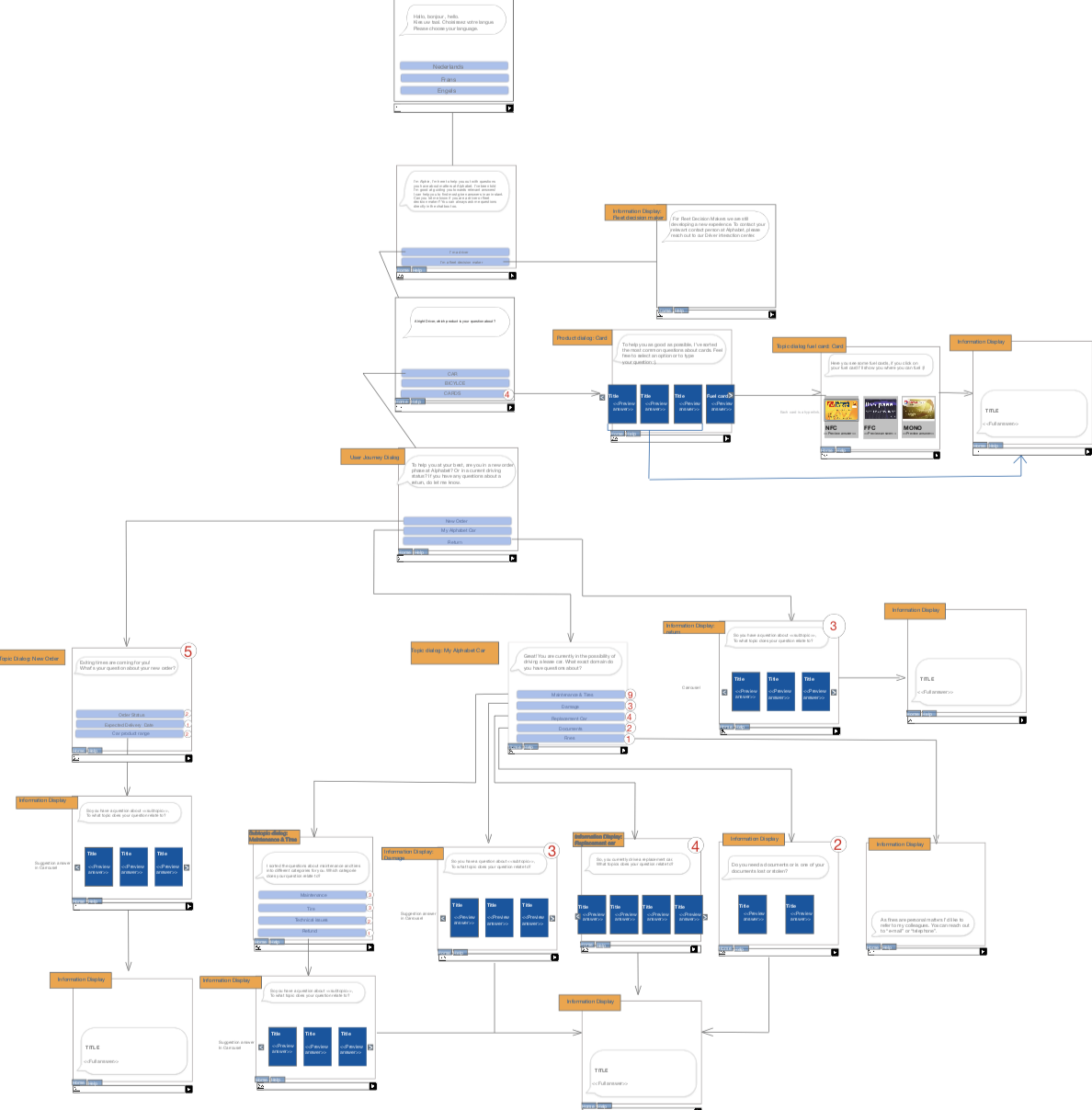

Workflow: The data is initially analyzed using standard outlier-detection techniques in regression models. Having 11 known fraud cases within the data set allowed us to test model hypotheses. This yielded good models for most of the known fraud cases, but some remained under the radar.

We extended the research into the time and connection domains. We built time series to find behavioural patterns in time, and outliers thereof. This allowed a refinement of the detection model, but still missed two important known frauds.

The final step was to connect all data and build an interaction graph of all connected entities in the data model. This was done using a specialized graph database and apply graph analytics on it.

Outcome: These analyses actually have a broad application in business cases.

-

The result was astonishing; not only were the two remaining known fraud cases clearly picked out, a lot of other candidate cases showed up.

-

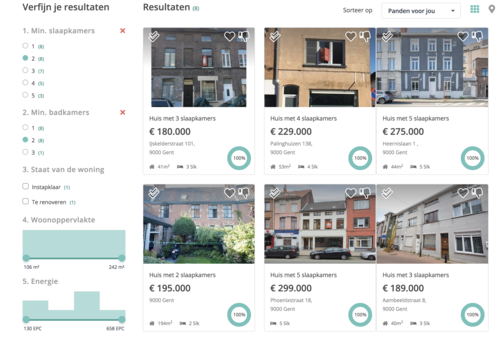

A tool for the officers, with which they can play around in a multi-dimensional domain model and they can then focus their field visits on the peculiarities from the model.

The tool we’ve created to detect fraud with service vouchers for WSE, Vlaamse overheid is clearly paying off. De Tijd noticed our remarkable results and wrote an interesting article about it.